Solar earnings show demand fears overblown

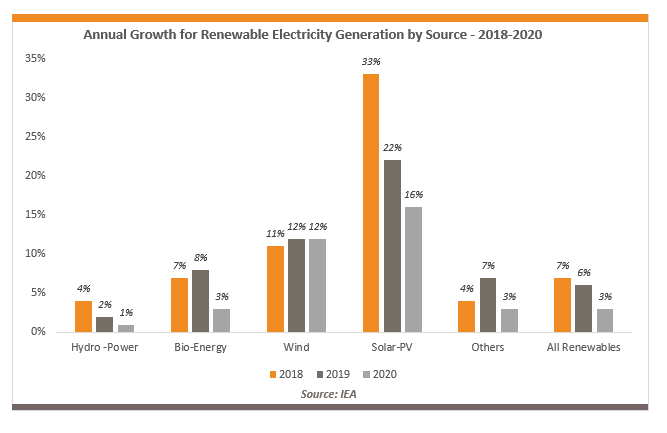

Solar energy product companies are almost certainly to shock investors this profits period of your time and effort with vibrant outlooks for 2020 as Italy as well as the us ratchet up ask for for panels pursuing a lower in federal government help within world’s largest pv market, Germany.

Fears of the deep regulatory overhaul in Europe have overshadowed pv stocks in latest months, pressuring valuations as investors fretted that subsidy cuts in Germany, France collectively with other markets would generate an oversupply of solar PV panels that could deliver screen costs lower substantially and harm manufacturers’ profits.

But makers of pv cells, modules and equipment for that subsidy-dependent industry are anticipated to produce powerful outcomes for that final three several weeks of 2020, and analysts explained ask for has remained powerful and costs have can be found lower much under expected.

“The Q4 reviews too because view will almost definitely are obtainable in excellent than expected,” explained Needham & Co analyst Edwin Mok. “Expectations are reasonably reduced for that yr knowning that will generate the stock costs higher. ask for will almost definitely be relatively powerful this year.”

Click here to read about buy solar panels online

Investors are actually uneasy regarding the industry’s notorious long-term uncertainty, as governments in most beneficial markets ?such as Germany, France, Italy and Spain ?are both chopping industry help or preparing to complete so.

Wall road will almost definitely be looking for companies to manage how they are absorbing that decline, especially within German market, and regardless of whether they are able to expand their look at in development markets, which include the United States.

“While it could seem sensible on cardstock the real truth that 2nd 1 / 2 of 2011 will almost definitely be weaker, there may be generally an great chance that some factor could shock us: that could properly be the U.S.,” explained Commerzbank analyst Ben Lynch.

The United says is anticipated to overtake Germany because world’s largest marketplace for photovoltaic PV modules in 2014, information outdoors of your European Photovoltaic business Association shows, up from the existing fifth place.

Boosting optimism because of this year, U.S. President Donald Trump proposed to enrich funding for completely clean energy evaluation and deployment to more than $8 billion within fiscal 2020 budget.

In addition, expectations that most beneficial U.S. pv marketplace California will quickly need utilities to reference a 3rd of the energy technology from eco-friendly resources have underpinned a rally in pv stocks.

Germany’s SolarWorld before this thirty days explained the U.S. marketplace was creating strongly, expecting it to concern for around 75 per-cent of its gross sales within of the subsequent two years, a assertion which lifted the whole sector.

Demand within United says has also helped buttress pricing. For pv energy to change out to become extreme with energy energy from fossil fuels, costs on pv panels ought to hold on to fall. However, when costs fall much more speedily than makers can lower costs, their profits suffer.

So much this quarter, cost declines on pv products are actually much under anticipated at near to 8 percent, in accordance with Auriga market analyst tag Bachman, who explained Italy as well as the us are sopping up supplies of solar pv products.

“Things seem relatively wonderful for that pv marketplace as we key in the original 1 / 2 outdoors of your year,” Bachman said. “Italy as well as the U.S. are commencing to select up every one of that slack in Germany ideal now. That adds an refreshing air of bullishness.”

Expected subsidy cuts could quite possibly be also providing the business a momentary shot within arm, he added.

“Mini platinum rushes,” or spikes in demand, obtain place once the marketplace anticipates subsidy cuts, Bachman said. “That’s what is going on within original 1 / 2 outdoors of your year.”

One feasible chance to profits later on this yr are increasing costs on polysilicon, the industry’s vital raw material. Most companies have locked in polysilicon costs with long-term contracts, but individuals that should purchase it regarding the area marketplace could have their profits margins squeezed.

This quarter, increasing polysilicon costs could harm scaled-down chinese language participant JinkoSolar, in accordance with Bachman

Leave a Reply